A few months ago, I went down an over-engineered fintech rabbit hole to understand the unit economics behind the take rates for Cash App Pay as a response to Jevgenijs Kazanins’ very excellent fintech take on why Cash App Pay could be the next major driver of Block’s growth.

One part of my argument assumed that Cash App Pay was only available to Square Sellers, based on Block’s documentation and from integration docs from Stripe & Adyen (its recent strategic partners). Since that was the case, while it’s technically true that when a user uses Cash App Pay (CAP) at a Square seller, Cash App (or Square?) could earn a 2.90% take rate on this transaction, it’s not all incremental. Instead, that take rate is split between Square as the acquirer (revenue it was already getting) and Cash App as the issuer with no payment network in between, resulting in at most a 15bps incremental take rate, rather than the 2-3x markup that was proposed.

I thought I’d gotten the details mostly right, but an astute (though punishingly blunt) reader @cloud11101 claimed that I had gotten the premise of Cash App Pay incorrect (it works with merchants other than just Square sellers) AND the economics incorrect (that indeed Cash App alone is generating at least a 2.90% take rate on these transactions).

So who was right? And how does this game of take rates work? To figure it out, let’s go down another fintech rabbit hole to understand the 3 payment flows and where the take rates shake out. Onward!

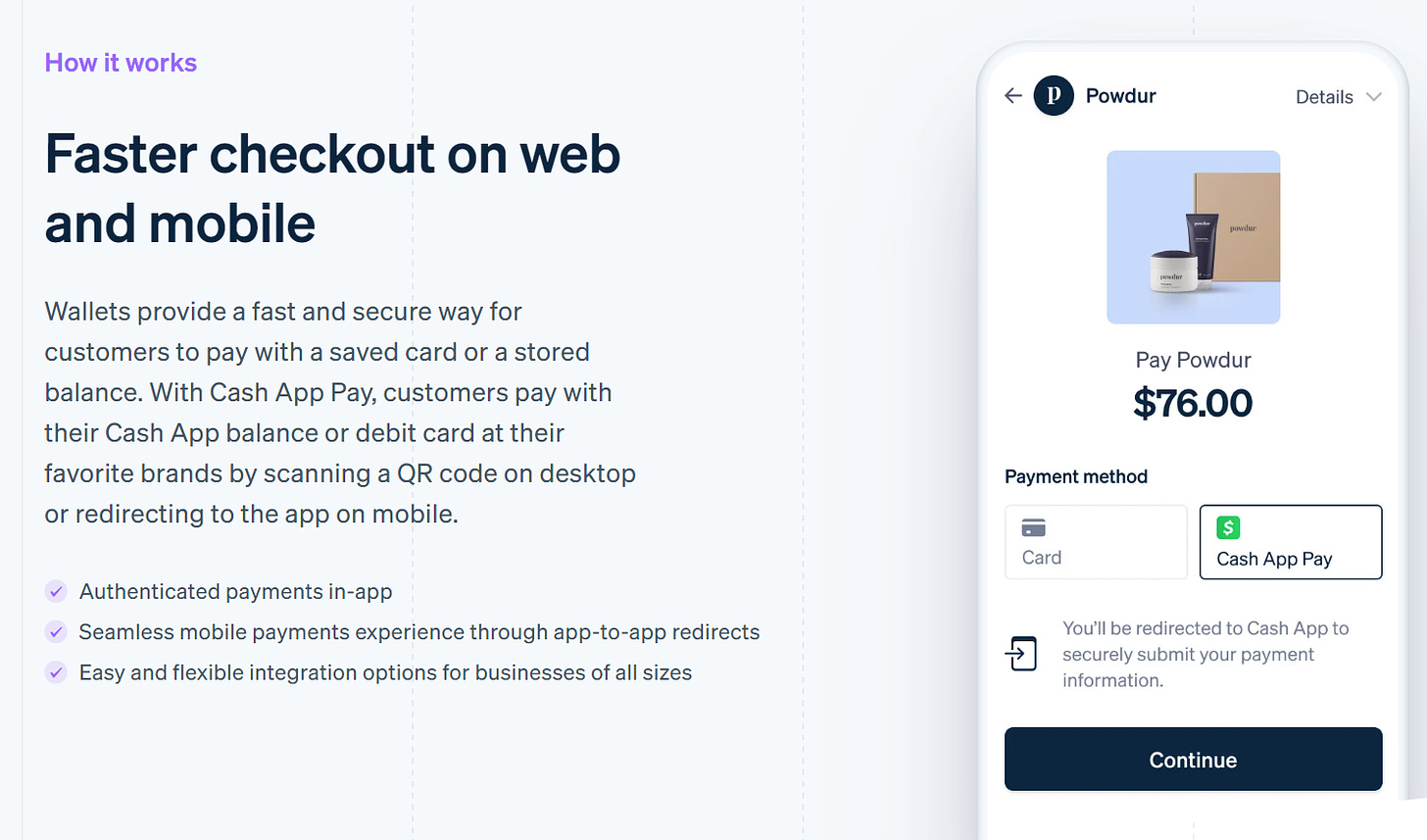

Cash App Pay for All

Now before we get into the cases, we do first need to set the record straight on who Cash App Pay is actually available to on the merchant side. Cash App’s documentation was far from clear and even Stripe & Adyen’s didn’t help too much (at the time Stripe’s docs had noted a requirement to be a Cash App business as part of the integration but these have now been deleted).

But it is clear that as of September 2022, Cash App had expanded the network of merchants that could use CAP to select large third party merchants outside of the Square seller network (though most of these merchants process via Stripe or Adyen). And as of 2024, it seems possible to check out on merchants like Doordash using Cash App Pay per recent marketing (though this is likely simply through Doordash’s payment processor, Stripe, as an existing integration).

This fact was surprising to me, but not in the ways you’d think. What I realized was that the $2.5bn in annualized volume processed on Cash App Pay should not just be compared against Square Seller annual volume of $209bn but actually the total volume across all merchants that can now integrate with Cash App Pay, which means their actual market share is actually far lower than the 1% I assumed. On the one hand makes $2.5bn even less compelling in absolute, but on the other hand, it means the opportunity for growth is massive (and the 7x growth YOY does speak to it). In any case, I didn’t have it quite right on what merchants can use Cash App Pay, but does it actually change the economics?

Let’s look at 3 payment flow use cases to figure it out:

Case 1: Cash App user buys from Square Seller via Cash App Pay

Case 2: Cash App user buys from Stripe/Adyen merchant via Cash App Pay

Case 3: Cash App user buys from select third party merchant via Cash App Pay

(As an aside, a still unanswered question is, where does Cash App Pay volume processed by non-Square sellers get counted? It obviously won’t be counted as Square volume since it’s not Square sellers. Could it be Cash App Business volume as another smart user @nachunja suggested? But the volume doesn’t match the Business GPV definitions and these businesses aren’t all necessarily Cash App Businesses. Also, the numbers don’t really add up - as of Q2-24, Cash App Business volume was down 27% YOY, but Cash App Pay volume was up 7x YOY which is practically impossible if it was a subset of Cash App Business volume. So maybe this volume is not split out at all and just considered purchase volume, which is a bit surprising if it does indeed have a materially different take rate… unless it doesn’t).

Case 1: Cash App user buys from Square Seller via Cash App Pay

This case is mostly explained in my last post, but let’s reiterate quickly here. These sellers, often smaller merchants, are currently being charged 2.90% to process transactions via Square. So this In the status quo, without Cash App Pay, Square would earn ~1.85% in acquirer markup and Cash App would earn 0.90% in interchange as the issuer for a total of 2.75% in take rate, with 0.15% going to the payment networks. In the Cash App Pay case, Square and Cash App would split the 2.90% Merchant Discount rate they artfully charged without having any money movement between Square and Cash App.

That all results in an incremental yield of ~15bps (what they’d typically pay the payment network). That’s definitely a useful arrow in the quiver, but it’s not going to be a gamechanger for the bottom line. And if it’s true that Square seller volume on Cash App Pay is likely <1% of the total volume on Cash App Pay as some readers mentioned, this isn’t going to be a needle mover on the whole.

Case 2: Cash App user buys from Stripe/Adyen merchant via Cash App Pay

Opponents of Case 1 really hone in on Case 2 and 3, that Cash App is able to charge 2.90%+ to non-Square sellers, even those on Adyen/Stripe. This case was initially thoroughly confusing, because it didn’t make sense why Stripe and Adyen would ever voluntarily partner with their competitor on merchant payment processing. Would they really be willing to go through the process of integrating Cash App and giving up any part of their 2.9% transaction fee, just so their merchants could offer a better checkout experience to Cash App users? The incentives already wildly favor Cash App (their users already get a better experience, they earn interchange as an issuer and increase brand exposure) so getting any part of the acquiring interchange seemed too good to be true.

From a checkout flow perspective, it would be completely out of market with other checkout experiences that Stripe/Adyen could integrate. Google Pay and Shop Pay’s branded checkout experience are free for merchants and even Apple Pay’s checkout doesn’t charge merchants, but actually issuers (any fees incurred are those from the actual processing of transactions). It would be a tall order for Cash App to convince Stripe/Adyen that Cash App’s own checkout experience (which only supports one payment method) is somehow so valuable it would be worth an incremental fee when that same Cash App user could just as easily checkout via a Google Pay or Apple Pay checkout flow by adding their card to those wallets, all for free for the merchant and processor. So it’s unlikely that the Cash App Pay checkout flow allows for any incremental take rate.

From a payments flow perspective, it is also hard to see where Cash App could justify charging 2.90% or anywhere close. Since the merchant is a Stripe/Adyen merchant, Stripe/Adyen would be doing the actual work for the merchant of processing the transaction (could Cash App really charge 2.90% to NOT process a transaction?). And since money is flowing across the payment networks from merchant bank (which is by definition not on Cash App or Square), the payment networks need a cut of the take rate. So Cash App is likely left where it started - it will get its share of the issuing interchange but no more than that because it is not processing the transaction as an acquirer and it is not bypassing the payment networks, so no incremental yield.

So what does the Cash App Pay checkout experience amount to in the Stripe/Adyen case? It’s simply a branded checkout flow that allows for automatic pre-filling of card and billing information, very similar to any other wallet that Stripe already integrates and is incidentally exactly how Stripe describes the Cash App Pay integration. Stripe/Adyen aren’t working with their competitor at all - they’re simply enabling a wallet provider to have a branded checkout experience. The world makes sense again.

Case 3: Cash App user buys from select third party merchants via Cash App Pay

It looks as though Cash App Pay won’t result in substantial incremental yield as a Square Seller and it won’t result in any incremental yield in a payment processor partnership, but what about through their select third party merchant integrations, as in the case of American Eagle, Aerie, Tommy Hilfiger, Finish Line, Shein, JD Sports, Doordash and a slew of select enterprise retail launch partners? Let’s ignore the retailers that are actually just large merchants that already partner with Adyen and Stripe (and are therefore in Case 2’s world). What about those where there is a direct partnership? Could Cash App then somehow charge a 2.90% take rate to these merchants?

Unfortunately, the likely answer is no, for at least a few reasons. First, while their processors may not be Stripe or Adyen like in Case 2, they by definition are not processing with Square, which means that Cash App Pay would not be processing the transaction on the merchant’s behalf and therefore could not charge 2.90%, just like in Case 2 (their merchant processor would charge that rate).

But what if somehow Cash App Pay was magically taking the role of acquiring processor in these transactions through this checkout flow though, perhaps as a requirement for using the checkout flow itself - could they charge 2.90% then?

Still no. That’s because when you process over a certain volume in sales (usually ~$1mm), merchants are usually eligible to use Interchange+ pricing rather than the flat rate 2.90%. Interchange+ (IC+) pricing is well explained by Stripe, but essentially the fee for these transactions becomes the actual interchange rate plus a small markup which covers the cost of processing the transaction and some fees set aside for the payment network.

Large merchants are already getting IC+ fees on other transactions, so it’s highly unlikely they’d take anything else for Cash App Pay transactions, especially when we know that every other checkout experience is going to be free for them. So playing it out in this case, as we know from Case 1, the interchange would go to Cash App as it always has, the 15bps would go to the payment networks so we’re probably left with at most 10-15bps incremental yield at max (and that assumes essentially no processor COGS).

As with Case 2, it is highly unlikely there is any incremental take rate yield for the Cash App Pay checkout experience because, crucially, Cash App is not the acquiring processor in either of these cases. Even if in some unlikely scenario Cash App Pay was the acquiring processor, enterprises would not pay the 2.90% rate but rather interchange+ pricing, meaning that at most Cash App is earning 10-15bps of incremental yield on these transactions.

Payments are a flat circle

So where we end up is where we began, that Cash App Pay isn’t going to be the massive incremental yield generating feature that some of us were hoping for. But we’ve learned more along the way and expanded our understanding of why there isn’t an incremental yield opportunity in every potential case.

That said, Cash App Pay is still a unique and compelling payment experience that offers two distinct flavors of marginal but incremental yield.

For Square Sellers and Cash App users, it’s the first large-scale attempt in a while at a closed loop payment network similar to PayPal, and the incremental yield can be generated from cutting out payment networks from the take rate pool.

For Non-Square Sellers and Cash App users, the branded checkout flow offers a frictionless checkout experience that competes with Google Pay and Apple Pay and a hypothetical chance at earning marginal incremental yield on each transaction

It’s still early days for Cash App Pay and there’s definitely potential for the economics to change over time. And with scale, who knows how the economics negotiations may change. With enough exposure, perhaps users won’t just prefer the branded checkout experience but demand it as a precursor to making purchases and merchants may be obligated to pay up for that benefit.

If nothing else, it’s cool to see a big company taking big bets, and I’m rooting for them to disrupt the status quo.

I want to take a moment to thank folks who took the time to read this write-up and to critique it. I’m always learning, and I appreciate the feedback, comments and thoughts so keep sending them my way!