Are we letting media perception and faulty metrics guide economic policy?

Original thread:

The latest jobs report from July confirms we may be thinking about the economy wrong.

#1: The metrics we rely on for recessions don't work in this environment (GDP & CPI)

#2: Even if it’s not the full picture, Wall St & Tech issues are warping our perception of economy.

On #1 - it's just not clear to me that the normal metrics we use to take action against inflation (CPI/PCE) or that we're in a recession (GDP growth) are actually working as indicators. These metrics don't disentangle cause/effect & don't handle huge shocks like the pandemic well.

Re: GDP growth, the counter to the growth narrative often includes a reference to Real GDP growth (2 quarters of negative growth). But that metric is so tied up in Fed & government action AND it's still not clear it's a leading vs. lagging indicator at this point.

For example, in Q2'22, despite increases in consumer spend, income & employment, real GDP was down. Why? Because Federal spending & residential + private investment were down, all of which are related to rising interest rates. So what's the cause and what's the effect?

The Fed interest rate changes were highly anticipated & have major impact on investments so it's logical that we see decrease as a result. I know GDP growth metric is important. I'm just not sure decline is a sign of economic weakness or a result of Fed action / anticipation.

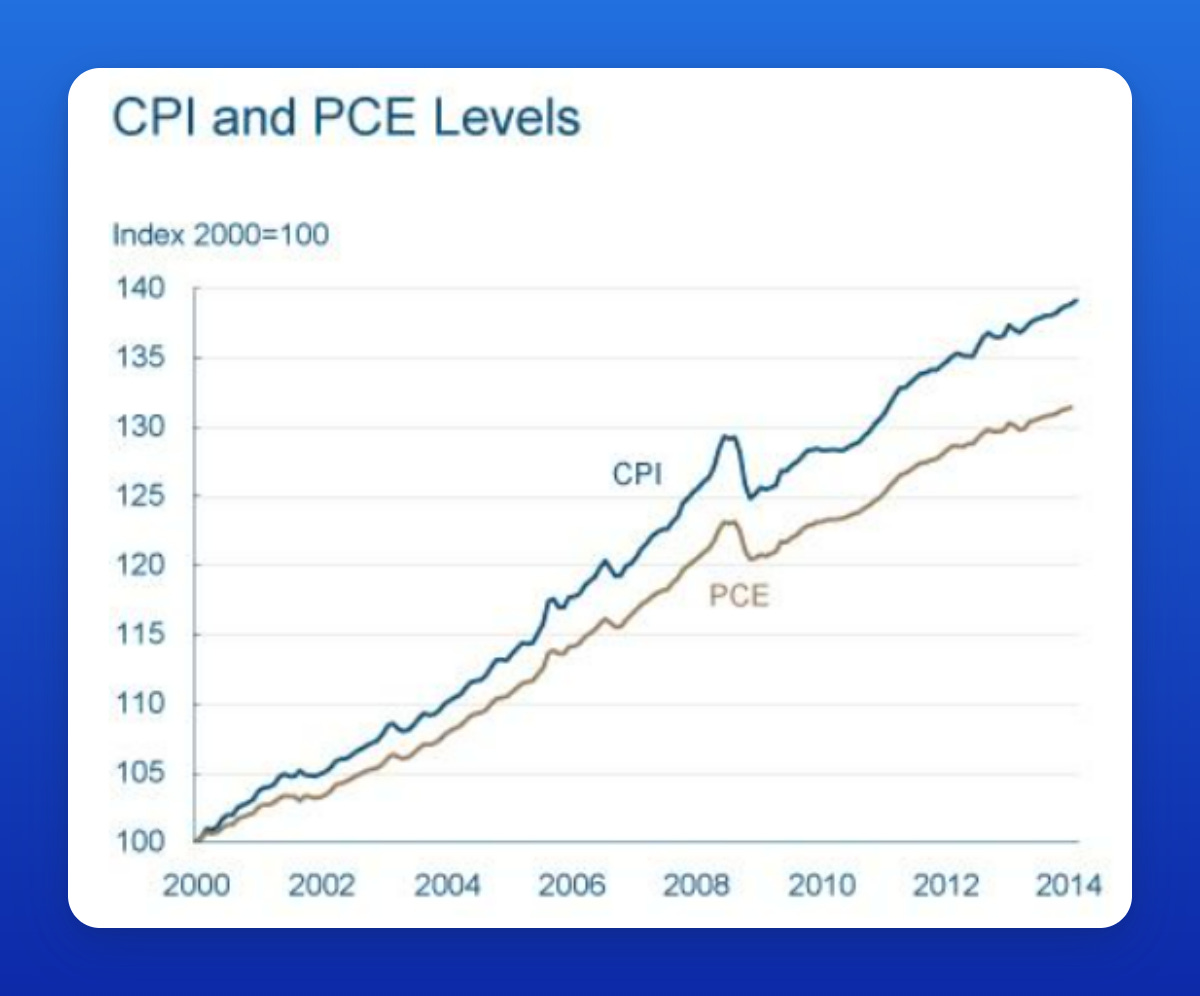

But the big metric that seems to outweigh all others is CPI (Consumers Price Index). CPI, often reported Y/Y or M/M, paints a grim portrait about the state of prices in US economy. That metric alone seems to force Fed's hand (Fed uses core PCE but similar as you'll see below).

On the surface, CPI seems like a good metric. The BLS surveys a representative sample & asks them about the price they paid for various purchases. Then they calculate indexed prices based on a fixed set of consumer goods (food, travel, housing etc) in fixed proportions (a "basket").

I won't spend much time on the methodology of CPI measurement but here's a few Fun Facts:

Fun Fact #1: The survey relies on humans writing in price diaries & talking to interviewers about prices. Aren't there more accurate sources of data (like consumer spend data by network by MCC)? The CPI surveys feel so prone to human error. How often do you remember specific prices? Is that before/after tax? Was it on sale? Did you go to the same place? Best case, you look at your own bank statements so why doesn't the BLS just start there?

Fun Fact #2: Despite CPI being widely reported, the Fed doesn't use it because they also think consumer surveys are less reliable. Instead, Fed uses distinct Core (ex. energy, food) PCE (Personal Consumption Expenditures) with a business sample instead. It's still survey-based but more consistent.

Beyond methodology, both CPI/PCE don't caveat a big shortcoming of measurement: CPI measures what people on average paid for goods NOT average prices. That's a big difference. That mean it can be confounded by massive changes in consumer Willingness To Pay (WTP), especially right now.

A thought experiment:

Say it's '20 & there's a flight to NY for $500 (+15%). You pass because it's a pandemic. CPI stays flat.

Now it's '22 & flight to NY is still $500. You take it because you didn't travel in 2 years. CPI goes up.

Prices are flat but CPI goes up. See the problem?

It's an extreme example but illustrative. In reality, we know prices are prob going up. But CPI is also prob overstating because: We are more willing to spend on expensive things than before because of the way pandemic changed our behavior.

Reframed this way, consumers aren't paying higher prices because they can afford to. They're paying higher prices because they can't afford not to - they can't waste the opportunity. After life was taken away with pandemic deaths, lockdowns, travel restrictions, consumers WTP for life experiences have gone way up.

That's part of why measuring Y/Y changes in CPI isn't the right way to gauge prices right now. 2022 also SO different from 2021; it's not comparable.

Vaccines were not widely available until Apr '21

Lockdowns and travel restrictions existed through '21

War broke out in Feb '22 and worsened global supply shortage of '21

There's a reason every public company took 2020 out of comparison set for earnings calls. And we're seeing same whiplash in '22 for changes in '21 (e.g. stock trading slowdown, ecommerce slump, staffing shortages, flight delays). So how could Y/Y CPI be relevant right now?

But despite the lack of clarity, the Fed is taking huge steps to reduce money in system. Recent interest rate hikes are fastest in 30+ yrs. Quantitative tightening (QT) = reducing balance sheet size is ~2x peak QT in '19 (which led to its own crisis).

Let's go back to micro-economics 101 where price is a function of supply and demand. Supply shocks and war reduce supply. Demand is higher but not with extra money but higher WTP. So Price is higher but not in typical way. So is taking money out of system the right solution?

So where are we?

I don't think we're in a recession yet. No consistent signs of downturn yet.

I think inflation is definitely happening but it's not clear it's as bad as it seems given huge changes in consumer WTP.

So I worry that Fed QT going too quickly in what may be a pyrrhic victory.

On to #2 - It's been a while since economic slowdown strikes first on Wall Street & Tech before making its way to Main Street. Since the first two are overrepresented in media and in our views on state of "market" (i.e. stock market), our idea of how bad things are is warped.

Inflation, rising interest rates, crypto meltdown, normalization of tech multiples. That hurts big investors and VCs. That kills fundraising environment for startups & tech firms and drives layoffs - all highly indexed to stock market. But it hurts SMBs & real output less.

Let's pressure test with headlines:

"US Economy adding 500K non-farm payrolls"

"Hedge fund loses $20B AUM from crypto volatility"

"Big Tech lays off 15-20% of workforce"

Which headline is going to grab airtime? The markets are clearly saying it's not (1).

I get it. (2) and (3) are a shock to the system and unprecedented in recent history. It's an easier story to tell that fits in with overall recession fears. But I think it's clear which event (1) has a bigger sustainable impact on the economy & that's what should drive policy.

An aside, I am not minimizing what's happening in tech & startups around layoffs and downturn. I have friends that have been a part of layoffs, have had to navigate tough fundraising and who have been affected deeply by this shift. It's awful and I'll help where I can.

Back to the thread - I'm no economist so maybe Main Street is in for pain later (banks clearly building up loss reserves for this), but the fact that credit has increased and consumer spend forecasts from AmEx, Visa, Affirm all still trend positive seems good for economy.

Whatever the case, our perceptions of what's going on are very different from reality. And it kills me that our perceptions are driving actions more than what's really happening since those can be influenced by imperfect metrics and loud voices.

That's a wrap for now. As always, strong opinions, weakly held. Open to debate! If you like what you read - please share and comment - I appreciate you! I try to write over-engineered fintech threads often so follow me @heysamir_ for more nerdery coming soon.

References:

BLS CPI survey methodology: https://www.census.gov/programs-surveys/ce.html

GDP growth: https://www.bea.gov/news/2022/gross-domestic-product-second-quarter-2022-advance-estimate

PCE vs CPI: https://www.callan.com/blog-archive/cpi-vs-pce/

Fed Changes: https://www.atlanticcouncil.org/blogs/econographics/deploying-qt-the-fed-readies-its-new-tool-to-fight-inflation/

Interest Rates changes: https://www.fitchratings.com/research/sovereigns/fastest-rise-in-global-interest-rates-for-30-years-17-06-2022

Money Markets in 2019: https://www.federalreserve.gov/econres/notes/feds-notes/what-happened-in-money-markets-in-september-2019-20200227.htm