[ATOM] The sobering reality about fintech FDIC insurance

Strong opinion, weakly held: Fintechs that offer FDIC insurance as a way to increase trust are marketing an empty promise. As we saw with recent fintech bankruptcies, insurance doesn't protect users from collapse of fintech but rather their sponsor bank. So it doesn't really help.

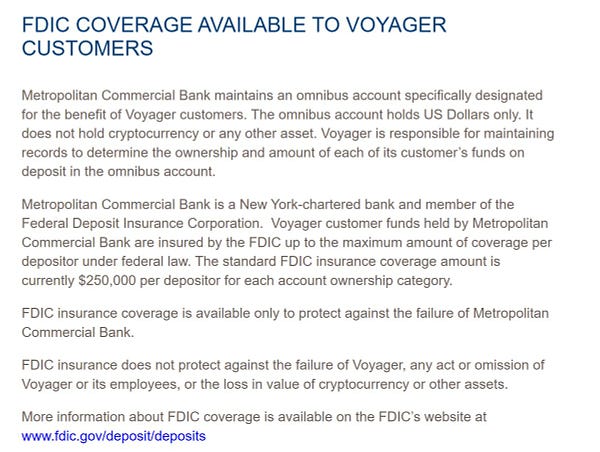

The part about FDIC insurance only protecting against the failure of the underlying sponsor bank and not the failure of the fintech itself is a big adjustment to what is generally understood by an "FDIC insured" fintech.

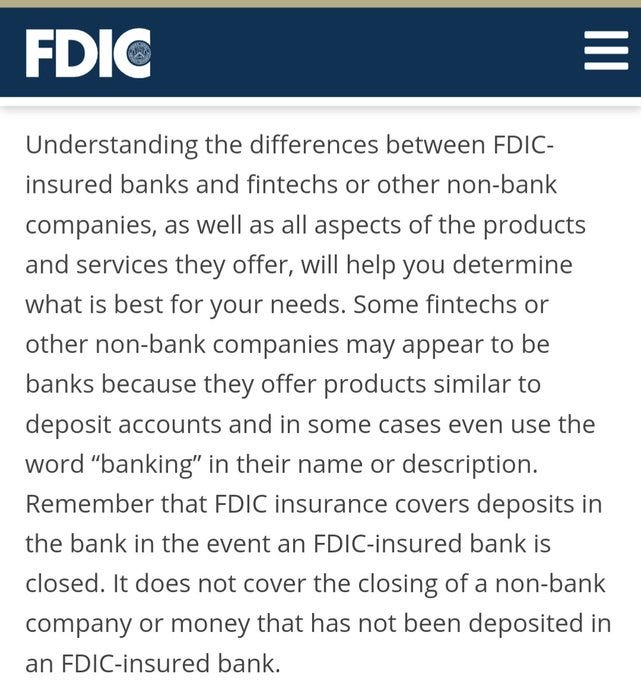

The FDIC website confirms Metropolitan's summary and specifies that even if a fintech partners with an FDIC-insured bank, if the fintech fails, your money is only protected if it is held in the FDIC-insured bank. This statement is true for FDIC-insured cryptos and fintechs.

I will say that "pass-through" FDIC insurance is still valid. Pass-through insurance refers to fact that although all accounts are only split virtually & there's technically only one "omnibus" account at a bank, each customer still has individual FDIC insurance up to $250K.

Still, this doesn't matter if fintech fails & hasn't held customer funds in FDIC insured banks (in USD).

Voyager is a messy example though for other reasons. I wondered why a platform would have customer funds risk in the first place, but maybe they weren't holding funds properly. Notably, you won't see an answer like this on Voyager's website:

It's surreal to see how much of this info is hidden in plain sight in Voyager's customer agreements (including everything Metro said). And the most vague disclaimer of all time about what happens to crypto deposits in event of Voyager insolvency. https://investvoyager.com/useragreement/