Sustaining its Competitive Advantage – Why Apple is Ripe with Opportunity

Resharing an essay on Apple's strategy originally written December 2012

I recently rediscovered an essay I wrote more than 10 years ago covering the opportunity I still saw for Apple in the face of what had then seemed like the decline of Apple’s mobile dominance as Android’s market share continued to rise. My friends might be surprised by my perspective, given I’m an avowed Android / Windows user, but my strategic finance nerdery has me begrudgingly admitting there’s a case for great strategy around unit economics and business model optimization.

10 years on, I think a lot of this story still holds and it’s a good case study on many of the tenets I mention in my fintech essays so I’m re-sharing today. In fact it’s a bit surprising how much of what we talked about in the past continues to be true today. Let’s see what we continue to do the same and what thinking different will be all about in 2024 and beyond.

Is it the End of Apple?

Apple is doomed, or so the headlines say. They point out Android's market share, which has topped 75% leaving Apple with a meager 15%.1 They highlight tablet market forecasts, which predict Apple will lose 25% of the segment by 2017.2 They deride Tim Cook, who they say will never match the visionary status that Steve Jobs accomplished.3 And they emphasize Apple's precipitous stock decline since the release of the iPhone 5, a foreboding omen of what is to come for the already troubled company.4 With all of this troubling news, Apple's future is bleak, the pundits say, relegated to obscurity in the near future.

But, contrary to the claims, Apple not only has a set of competitive advantages that enable it to compete in the present, it continues to deliver on a value proposition that will sustain its growth into the future. Apple will continue to focus on delivering consistent and intuitive experience-driven innovation built around users that integrates across product lines while unifying its brand image. Apple’s competitive advantages start with its company fundamentals, and its encompassing value proposition appeals to consumers who buy Apple's products, content producers who enhance the user experience, and investors who care about the bottom line. In short, Apple's doing enough to keep it relevant for a long time.

Apple’s power starts with its fundamentals5

The power of the Chinese iEconomy6

For Apple, the strength of the business starts with its cost advantage, and it has spent millions of hours developing a manufacturing economy overseas in China that cannot be surmounted. This iEconomy relies less on lower worker compensation, which is minimal compared to factory parts, and more on significant economies of scale and scope that have flexibility that cannot be replicated in America. Apple’s Foxconn site in China is a city of factories where every part can be flexibly scaled up and down according to demand, and where hundreds of thousands of workers can churn out iDevices at speeds that competitors cannot match.7

The iEconomy has important implications on the way other companies compete. It is the reason why an iPod Touch can sell at $229 and still make money for Apple; no other company can afford to offer a competitive device at Apple’s price. It is also the reason why almost all of the competing tablet variants for the iPad use a 7-inch screen, since nobody can afford to match the iPad’s price with a comparably sized touchscreen display.8 As Amazon, Samsung, and Google continue to sell hardware at cost in order to break into the market, Apple has historically achieved 30-50% profit margins on its devices, even with competitively priced products.9 Because Apple has utilized its iEconomy to focus on device profitability from the start while competitors have relied on volume-driven profitability, Apple will continue to exert significant cost advantage over competitors until they completely overhaul their manufacturing economies.

Supply chain of command

Apple’s supply chain is central to its cost advantage and is a key sticking point in keeping the competitive advantage sustainable. Apple has been focusing on supply chain management since 1997 and the long years of focused management consistently put it among the best supply chains in the world.10 Apple’s huge supply chain, led by now CEO Tim Cook, can command volume discounts on device components, while its analytics allow it to adjust track and measure production forecasts from the factory parts to the finished retail product on the shelves.11

Since the beginning, when Jobs bought out all holiday shipping airspace to beat out competitors, to its massive buyout of all NAND flash storage that prevented other firms from making comparable music players, this focus on supply chain management allows Apple unparalleled flexibility in buying device parts and setting prices. Here, a closed ecosystem pays off and the control of every aspect of production gives Apple a time-tested, honed, operational edge that few competitors without that mastery can hope to match. It also paves the way for manufacturing of larger-scale items like televisions with low costs and high profit margins.

Apple offers what consumers want

Thinking Different

By far the most ubiquitous aspect of Apple's strategy is its focus on innovation. But Apple has a different take than most competitors; rather than spending millions on technological innovation to inspire new experience,12 Apple spends millions on understanding existing experiences to drive technological innovation.13 Apple has spent decades honing its culture on

experience innovation, becoming the brand that pioneers new ways to think about old problems.14 So, whereas phone makers used advanced technology to make their devices smaller and faster, hoping that consumers would buy into the aspect of additional portability, Apple released the first advanced touch-screen smart phone, the iPhone, that addressed the basic

problem that "everybody seemed to hate their phones...Let's make a great phone that we fall in love with."15 The focus is not on cutting-edge features, but on cutting-edge experience; it is not about packing a device with the best technology, but making a device so ideal for its use that it is the intuitive choice.

This focus on experience over features is a centerpiece for Apple's strategy; it is the basis for the iPod (let's make it easy to get music portably), the iPad (let's make media consumption interactive and user-friendly), and the (potential) iTV (let's bring simplicity back to our television sets).16 It is why Apple has led the product revolution and competitors have only followed in their footsteps and attempted to differentiate for every product launch from the iPod, to the iPhone, to the iPad, and beyond. To be clear, this focus isn't always initially popular, but experience-driven innovation usually pays off because it always addresses a market in need.

Consistency is key

At the core of Apple's product experience is a focus on consistency. It starts with a simple, but unique product design with glass, aluminum, a single home button, and the iconic glowing Apple icon on every Apple device. Sleek design, high build quality, and consistent image make it clear that whatever your device, you're buying an Apple product.

Competitors do not universally follow this tactic; Samsung has released at least 65 products with differing keyboard styles, varying screen sizes, and changing form factors.17 That consistency drills down to the heart of the operating systems and the individual apps. iOS, Apple’s mobile operating system, looks and feels the same on every device, making it easy to pick up an iPad if you’ve ever used an iPhone. Consistency is also a requirement for each app as stated by the iOS Human Interface Guidelines, so across all apps, the placement of on-screen buttons and use of gestures is the same.18 In comparison, carrier branding, individual handset variations, and user-directed theme customization can make an identical operating system on two phones look completely unrecognizable. Moreover, until this year, Android did not even have a consistent set of design principles for making apps and hundreds of thousands of existing apps in the Play Store don’t follow the new rules.

A focus on consistency is not without its tradeoffs. It forces Apple to limit update cycles for its phones to bi-annual refreshes, and large-scale changes that consumers want can take longer to bring to market. But for this set of tradeoffs, there are additional benefits. For the consumer, a limited number of devices makes it easy to choose what you want based on your preferences, and the stable update cycle gives consumers the security of knowing that they are getting the best Apple has to offer and support for six months to one year.

Meanwhile, a limited number of products allows for the creation of an ecosystem of devices, unified by iTunes, that guarantees that content like books, music, and media work on all devices all the time. The focus on consistency has paid off; over 94% of iPhone users plan to purchase another iPhone compared to 47% of Android users who will buy Android again.19 Crucially, this advantage is sustainable; it relies on a complex set of tradeoffs that would force other vendors to completely rethink product cycles and innovation focus to compete.

Apple provides what content producers need

Showing Developers Some Love

For Apple and its competitors, content is as important as hardware, and the difference between the development platforms is clear. Whereas Apple relies on a mature Cocoa framework with a number of developer tools, an avid developer community, and a wealth of open source code, Android’s tools are “clunky,” updates are fragmented, and testing is nearly impossible with the number of devices.20 These problems seem to plague Windows and Blackberry platforms as well, judging by the immense difference in the number of apps available in these stores.

In addition, though Apple’s App Store is curated and can be restrictive, it stops the ultra high rates of piracy that destroy the profitability of Android apps.21 Combined, these factors have a big impact on how developers approach the two biggest platforms. Despite its huge market share, apps like Facebook and Pandora continue to be developed for iPhone first, Apple’s apps make 8x the revenue of Google equivalents, and over 25 billion apps have been downloaded in the Apple App Store compared to 10 billion from Google, all when Apple has only 7% of global market share.22 Importantly, developers aren’t optimistic about Android; “the way in which Android is structured means that it will never be as dev-friendly as iOS,” says multi-platform developer, Jude Venn.20

Breaking up isn’t easy

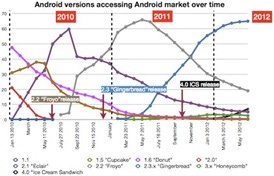

For Apple competitors, fragmentation is nothing new, but it is too often forgotten as the media tout Android’s massive market share numbers. The truth is there are nearly 4,000 devices running Android from 600 brands (Exhibit 2).23 That makes it impossible to test an app on all handsets and often, and compared to Apple devices, Android phones are plagued by resolution scaling problems, and compatibility issues that hamper developers. In addition to basic testing issues, Android devices have severe operating system fragmentation.23 Whereas over 61% of iOS devices run the newest OS, just 3% of Android devices run the newest operating system, Jelly Bean.24

This problem isn’t going away; it has been around since Android’s inception and there’s no evidence that it will decrease any time soon, especially with the number of devices in existence that constantly need to be kept updated (Exhibit 2). Importantly, there is a big impact on developers; Apple has 4x as many developers and 3x as much revenue as Google despite accounting for 20% of the market share.19 Moreover, whereas Apple has a clear incentive to roll out updates to keep users and developers on their platform, carriers and Android handset makers, disconnected from Google’s Android iteration process, have more incentive to get users to buy new handsets instead.25 Misallocated development resources and misaligned incentives make the Android problem more systemic and harder to recover from.

Apple delivers what investors care about

Why market share leadership doesn’t matter

The most often quoted metric of Apple’s diminishing market presence is its consistently decreasing smartphone market share compared to Android devices. However, this metric is flawed in more than one way. In comparing Apple to Android devices in general, you are really comparing Apple to Google, who develops the free Android software with zero profit on the Android handsets and roughly $6-10 per phone in ad revenue.19

Compare that to Apple, who makes at least $300 per phone and $200 per iPad, before even factoring in ad revenue, and the differences become clear. That means, for Google’s Android platform to even match Apple’s profits, it would need 30:1 ratio of market share, which is very unlikely to occur.19

When comparing Apple to individual handset makers like Samsung, HTC, and LG, the statistics become even more sobering for Android developers. Apple’s smartphone share has been increasing since October, and it commands 60% of the profits in the industry. Samsung, its biggest competitor holds 39% of the profits, and no other companies are profitable (Exhibit 2). 26 In the tablet market, where Apple continues to dominate both market share and profit share, the implications are amplified. That means that even with a smaller market share and fewer device choices, Apple continues to have significant profits that aren’t going away, and that matter for investors interested in the stock.

If this feels like déjà vu, that’s because it is. Google’s Android push mirrors Microsoft’s Windows focus in the computer industry. The common sense notion, that an easy-to-use open system could be adopted on multiple platforms to deliver volume-driven revenues makes sense in theory. But, in practice, it puts companies that use the Android platform in a difficult position because they (a) have to be the best – and most differentiated - among Android phones and (b) be the best among all phones, Apple included. It also strains the relationship between Google and its hardware partners. While Google wants to focus on unifying and consolidating its platform experience, hardware manufacturers want to differentiate their handsets to retain competitive advantage, further fragmenting the industry.

So while Apple can continue to perfect its consistency and delivery of high margin devices, Android manufacturers are embroiled in price-cutting and incremental competition that leaves few companies profitable. Apple also retains negotiating power with carriers who provide lucrative phone subsidies to Apple’s products while playing Android manufacturers off of each other to lower prices.7 These subsidies benefit Apple’s profit margin without hurting the consumer; carriers absorbs most of the cost of the phone while consumers sees a competitively priced product. We know what the future of this industry looks like because it has already been played out in the computer industry; Apple will capture more profit than all competitors combined and, as the industry matures, market share and profitability will become a stable source of net income.27

“The Future is For Sale, and Apple’s Got Cash”28

Perhaps Apple’s most unconventional source of competitive advantage is its massive $100 billion cash pile.27 For Apple, cash has the ability to build on competitive advantages through operational excellence.29 Apple can double down on supply chain management investing to $7.1 billion to streamline manufacturing, spend billions on R&D, and commit over $2 billion to prepayments to key suppliers. The cash facilitates strategic acquisitions of ad revenue platforms that make up iAd, voice recognition companies that created Siri, and even software products like SoundJam, which became iTunes 1.0.30 It also goes a long way to paying for the multi-billion dollar legal fees to protect intellectual property and snap up patents that have maintained Apple’s dominance in innovation. It even goes to the $10 billion in share buyback and dividend program that encourages investors to invest in Apple.31 When other mobile device vendors are scrambling to make short-term profits, Apple’s huge cash position allows it to be long-term focused and reaffirm its competitive advantages.

Cook’s recipe for success

The leading pundits claim that Tim Cook is no Steve Jobs, and without Jobs, Apple is hopeless. They’re right that Cook is no Jobs, but he doesn’t have to be. Cook has a different set of expertise for a different type of industry. When Jobs was CEO, innovation was an essential part of Apple’s strategy to extend beyond the incrementally changing industry of computers into new product markets; Cook operates in a world where bringing existing products to new markets will be the key to sustaining profits and with his mastery of the complexities of supply chain management, Cook may be a better person for this job than Jobs.32

In fact, his expertise already seems to be finding success; in the Q3, 2012 earnings call, Apple reported a 48% increase in revenue from China year-over-year despite losing market share.33 This news is another important reflection of why market share is not always significant for a company’s prognosis; the smartphone pie in China is increasing because of an explosion in low-cost devices, but Apple is still delivering on growth targets.33 Moreover, a full 60% of Apple’s revenue comes from overseas, and the iPhone 5, Apple’s new phone, has already been introduced in 50 countries including key BRIC nations including Brazil, Russia and China, an international introduction that has not been matched by rivals like Samsung.34 Meanwhile patent infringement lawsuits and aggressive marketing make the iPads the most competitive option or the only one for emerging markets such as Korea and Taiwan.34

In addition to aggressively managing Apple’s existing product and distribution lines, Cook also has bright ambitions for the future direction of the company. “When I go into my living room and turn on the TV, I feel like I have gone backwards in time by 20 to 30 years… It’s an area of intense interest,” said Tim Cook.32 No more than a suggestion, it is still the biggest indication yet of a potential new experience Apple wants to tackle. This focus also makes sense given Apple’s existing expertise; their supply chain can adapt to a larger product like a television set and their media connections through iTunes as well as their existing Apple TV product will allow them to leverage expertise in the market. If Apple could make a radically better cable box TV set than competitors, cable television would become commoditized, and Apple could act as a profitable “dumb pipe” for television in the same way it has for movies and music.35 The market for Smart TVs is already large and is expect to grow to $256 billion in 2016, meaning even modest penetration into the market could result in billions of dollars of additional sales.36

Apple’s obsessive focus on delivering consistent and intuitive experience-driven innovationbuiltaroundusersthatintegratesacrossproductlineswhileunifyingbrandimagewill continue to outcompete rivals and propel its sustainable competitive advantages into the future.

Apple’s competitive advantages start with its company fundamentals, and its comprehensive value proposition appeals to consumers who buy Apple's products, content producers who enhance the user experience, and investors who care about the bottom line. With Tim Cook’s leadership and Apple’s encompassing strategies, a brighter (and bigger) future for Apple is just around the corner.

Sources

1 “Android Marks Fourth Anniversary Since Launch with 75.0% Market Share in Third Quarter.” IDC Research.

2 “iPad Tablet market share predictions in 2017” NPD DisplaySearch Tablet Quarterly Report.

3Interview with Elon Musk in TechCrunch - Without Steve Jobs, Apple is doomed

4 Daniel Bates – “Is Apple on the verge of a 'death cross'?” Daily Mail Online. 12/7/2012

5 I will be focusing on iOS powered devices (iPod (touch), iPhone, and iPad) rather than their traditional mp3 and computer products because the other products operate in stable, and arguably stagnating industries.

6 Charles Duhigg – “How the U.S. Lost Out on iPhone Work.” New York Times. 1/21/2012

7 I only make explicit references to only Android handset makers as Apple’s major competitor. That is because Android is at least equivalent to Windows and RIM from a competitive advantage standpoint and arguably better than both. If I can make the argument that Apple is more competitive than Android, then it follows that Apple is more advantaged than Windows or RIM.

8 John Gruber – “Apple’s Pricing Advantage.” Daring Fireball.

9 Horace Dediu - “The iPhone and Apple’s Margins.” Asymco. 10/29/2012.

10 Gartner Newsroom. “Gartner Announces Rankings of Its 2011 Supply Chain Top 25.” Gartner. 6/2/2011.

11 Adam Satariano and Peter Burrows. “Apple’s Supply Chain Secret? Hoard Lasers.” Bloomberg BusinessWeek. 11/3/2011.

12 Samsung. “Vision & Mission – Corporate Profile – About Samsung.” Samsung.

13 Ian Scherr – “Apple’s Secrets Revealed at Trial.” 8/5/2012.

14 Cliff Kuang – “The 6 pillars of Steve Jobs’s Design Philosophy.” Fast Code Design. 11/08.

15 Betsy Morris - “Steve Jobs Speaks Out – Exclusive Interview.” CNN Fortune. 3/7/2008.

16 Steve Jobs, Tim Cook. “Apple Keynote Presentations.” Apple.

17 “Samsung smart phones.” Phonearena.com.

18 “iOS Human Interface Guidelines: Introduction.” Apple.

19 “Apple ahead in mobile loyalty: Gfk research firm.” Reuters. 11/24/2011.

20 Damien McFerran – “Android vs. iOS: A developer’s perspective on the Big Two.” Know Your Mobile. 10/18/2012.

21 Mike Rose – “The Android piracy problem.” Gamasutra. 8/21/2012.

22 Darcy Travios. “Five Reasons Why Google Android versus Apple iOS Market Share Numbers Don’t Matter.” Forbes.

23 “The many faces of a little green robot – Fragmentation matters to the entire Android community.” OpenSignal.

24 Lance Whitney. Android 4.0 now on a quarter of all Android Devices. 11/2/2012.

25 Charles Arthur – “iOS v Android: why Schmidt was wrong and developers still start on Apple.”

26 Horace Dediu - “Smartphone operating profit shares.” Asymco. 11/14/2012.

27 Craig Lloyd – “Apple’s Profits Exceed the Entire PC Industry.” Slashgear. 11/26/2012.

28 “Cash Creates Opportunity at Apple.” SeekingAlpha. 3/6/2012.

29 Staff – “Building competitive advantage through operations.” Harvard Business School. 10/12/1999.

30 Matthew Luke – “Innovations Through Acquisitions.” MotleyFool. 9/7/2012.

31 Daniel Eran Dilger – “Apple to distribute another $2.5 billion to shareholders via Thursday dividend. 11/14/2012.

32 Josh Tyrangiel – “Tim Cook's Freshman Year: The Apple CEO Speaks.” Bloomberg BusinessWeek. 12/6/2012.

33 Ingrid Lunden – “Apple CEO Tim Cook Says China Q4 Sales Were $5.7B, Up 26% YOY, Flat On Q3; iPhone 5 Coming In December.” TechCrunch. 10/25/2012.

34 “Apple’s Best Hope Moves Overseas.” 24/7 Wall Street. 12/4/2012.

35 Jacqui Cheng – “Apple trying to woo cable operators into piping content through Apple TV.” Ars Technica. 8/16/2012.

36 Natasha Lomas – “Report: Social TV Market To Be Worth $256.44BN By 2017; Europe Taking Largest Share Now.” TechCrunch. 10/12/2012.