It’s been a wild week for the world of fintech, especially for pre-IPO neobanks, and I’m still not sure whether we’ve ended the week better or worse than when we started. We’ve had acquisitions, earnings and a healthy dose of regulatory action influence neobanking sentiment throughout the week. I’m highlighting three big stories this week and how I think they’ve impacted pre-IPO neobank valuation perceptions.

STARTUP SPOTLIGHT

Before we jump in, I’m trying something new out at the top of the newsletter with startup spotlights. I write over-engineered posts for fun and am lucky enough not to need ad sponsorships. But I also see a bunch of very cool fintech startups and ideas, and I want to support them and our ecosystem. Startup spotlights are just that - my honest, unpaid endorsement of fintech companies I’ve seen or heard about that can help make the ecosystem better. If you’re a startup looking for endorsement or know one that could use the shoutout, let me know!

First up, I’m inaugurating this segment with Bilanc, the unit economics analytics platform for fintechs (YCW24). Leo Ubbiali and Sam Akinwunmi have spent time in fintech at Curve and MoonPay and came to understand how crucial it was to understand and optimize unit economics for consumer fintechs so they’ve built a platform where you can attribute revenue and costs at the user level. That is instrumental for segmenting users, figuring out how to deliver and gate features and how to optimize and improve margins. I wish we had this at Chime and Unit - unit economics was essential to getting Chime to where it is now, but extremely manual and time-consuming for our StratFin team to manage. It’s early stage but promising and I’m happy to intro folks to Bilanc directly - shoot me a note!

Okay, back to the fintech emotional rollercoaster. Let’s jump in.

Monday

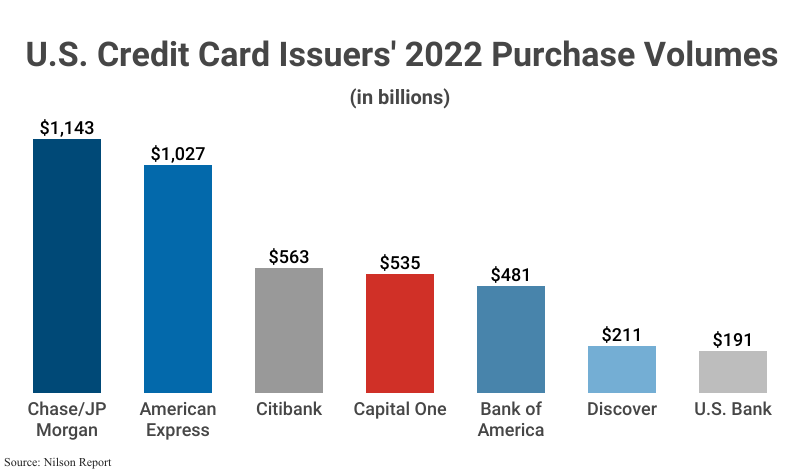

On Monday, Capital One announced its $35bn acquisition of Discover, representing a 27% premium to Discover’s closing price. Discover has had a tumultuous past couple of years including some merchant related issues and a recent FDIC consent order, but the the pro forma is still incredible for Capital One - 22% credit card market share and $250bn of balances, not to mention the ability to have an Amex-style vertical payments and shake-up the basic duopoly between Visa/Mastercard. Some think the strength of the deal is so much so that it won’t be approved but I have other thoughts (stay tuned!).

In any case, the acquisition shed light on just how big Discover is on its own, even though it's often relegated to last place when compared to Visa/Mastercard/Amex (let’s not forget Discover started it all with the first charge card in 1950!). Indeed, Discover has over $84bn in consumer deposits, ~$589bn in network payments volume, $230bn+ in credit purchase volumes and 305mm global cardholders which is impressive on its own. It translates to a whopping $16bn in 2023 revenues and $2.9bn in net income, likely higher profits than most neobanks have in revenue.

And if this company is worth $35bn, neobanks like Revolut (last valued at $33bn) and Chime (last valued at $25bn) are probably wondering what the market would pay for their assets when they each likely have lower volumes.

Overall pre-IPO neobank sentiment effect: Negative

Thursday

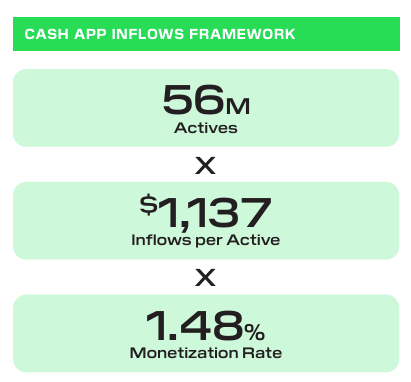

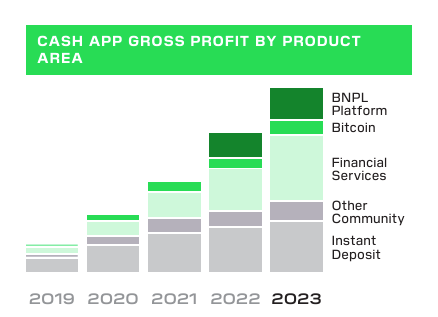

Of course, it wasn’t all doom and gloom in fintech world as Block reported earnings for Q4-23. This was a monster quarter for Block and for Cash App in particular with Cash App Card’s monthly actives up to 23mm (out of total Cash App actives of 56mm), a 20% yoy change while short-term loan originations rose 74% (though we’ll only see in the next 3-6 months whether this is actually good or bad for business).

Cash App also launched free overdraft coverage and high yield savings accounts (incidentally features that other neobanks like Chime have had for years) but the traction has been impressive for Cash app. All-in though, it was a monster quarter and year for Cash App with a whopping $5bn of revenue and $4.3bn of gross profit (ex. Bitcoin because the accounting is stupid).

Block surged 16% on the news and given that Cash App now makes up 60% of Gross Profits, we could guesstimate that the Cash App business alone is at least ~$30bn of the total market cap. There’s certainly a reward for scale that investors place on neobanks like Cash App, so pre-IPO neobanks may be able to benefit, depending on their overall scale.

Overall pre-IPO neobank sentiment effect: Positive

Friday

Of course the “fun” didn’t stop there, as our resident citizen watchdog Jason Mikula, had news for the fintech ecosystem about yet another consent order for a BaaS sponsor bank; this time it was Lineage. While this wasn’t entirely surprising given their dramatic few months, it’s yet another hit to the BaaS ecosystem that was supposed to power the new wave of consumer fintechs and embedded finance plays. With consent orders / enforcement actions against Blue Ridge Bank (Unit, Increase), Lineage (Synapse, Synctera), Cross River Bank (Current), Choice (Mercury, Lili, Unit), Evolve (Synapse, Stripe, Step, Dave, Solid) and others, it’s tough times trying to navigate the ecosystem and feel comfortable with building bank partnerships whether directly or through BaaS.

Practically speaking, that means the long tail of potential competitors to pre-IPO neobanks in the US isn’t likely to be able to catch up to them any time soon, and consolidation at the top is more likely than ever. But it also continues to shine an unwanted light on the potential weaknesses of non-bank financial partnerships with regional banks, and any regulation could impact the likes of Chime just as much as it impacts the smaller players.

Overall pre-IPO neobank sentiment effect: Neutral / Positive

What’s Next?

You’d think with this much news out we’d have some quiet for the next few months, but there’s still more neobank / neobank-adjacent earnings to come that will tell us more about the market (Green Dot, Marqeta), some potential IPOs (Stripe, Plaid) and who knows what acquisitions we’ll see. Exciting times to be in fintech!