Original post:

Full Thread:

It's like every time I tell people I left @unit_co_ to join HRT, they're ready to bash BaaS & write off the entire industry.

They couldn't be further from the truth.

BaaS still represents huge opportunity and Unit is the only one positioned to win. I'll tell you why.

Let me set up the hater's argument for you on why BaaS is doomed:

A) "With tight unit economics, BaaS margins can't work"

B) "Any company embedding fintech needs their own stack to innovate"

C) "Unit is competing with 100 other identical BaaS and can't differentiate"

(A) "With tight economics, BaaS margins can't work."

Let's tackle (A) first. People say this but it makes no sense. Who is getting the better deal?

1) Fintech A's volume

2) BaaS Platform with Fintech A's volume + 250 other startups

Hint - it's not (1). The math ain't mathing.

The name of the game is volume and BaaS will always beat out any one company's volume. I negotiated these deals directly for single companies (Chime) and platforms (Unit) - I know. Now at certain size, you might get a sweetheart deal, but that's far off for most fintechs.

Let's not forget basic economies of scale when Unit's team is standardizing bank onboarding, compliance, product approvals & Risk expenses upfront. Unit has a bigger bank compliance team than most fintechs AND sponsor banks, but it's also cost optimized across many clients.

And of course, Unit is optimizing negotiations w/ client unit economics in mind. There's no end game for Unit if its clients fail. So even with margins included, most fintechs get better deals with Unit than direct. Prove me wrong without citing unsustainable models like Synapse.

(B) "Any company embedding fintech will want their own stack to innovate."

Okay so (A) is BS - let's move to (B). People who say this might point to Chime & Brex & think it's so over.

But modern BaaS didn't even exist when they started... Times have changed.

The reality is most fintechs today should choose infrastructure platforms the same way most tech firms choose AWS. You shouldn't waste time building check OCR, ledgers, debit/credit/HYS and be negotiating vendors and compliance. You need to build, because you're already late.

Unit makes it so easy to offer all of that in a white-labeled way, it's dumb not to use it. Definitely the right starter pack. Until you reach super-scale where you're building EarlyPay or AI-driven Accounts Payable, Unit works for you. By the time you get there, Unit probably will have it.

And it's clearly working. Look at Unit's client list - scaled fintechs with PMF:

Consumer Banking: Seis (@TrevMcKendrick)

Business Banking: @bankwithrelay

AP/Billing: @Invoice2go, @honeybook

Angel Investing: @AngelList

Savings: @YottaSavings

And for all haters that say this list doesn't represent scale, what about these names on BaaS you've def heard of: -

@Shopify Balance + Credit Card (Stripe)

@Square (Marqeta)

@tryramp (Stripe)

Unit started 2.5 years ago (vs 5+ for others), so it’s only a matter of time before they’ve got a mega-enterprise to add to the list.

But the mega opportunity goes beyond fintech to all the other companies that could offer embedded fintech. When you're a big tech firm with existing products & you're introducing fintech, it could be a big opportunity in absolute but it's rare it becomes your main source of revenue.

So if that's the case, you're not going to go out and build a separate fintech stack, get in the eye of regulators and build out an entire non-core competency for 10-15% more revenue. If you don't believe me, look at Amazon and Google who tried.

Instead, you'll go find the best BaaS & use massive scale to get what you want. For example, if @salesforce was adding T&E cards for AEs, why would they build it alone vs going to BaaS for best products & price? But at 10% ARR ($10B+ revenue), that would be a megadeal for Unit!

So I think we can safely say (B) doesn't hold up - this is a big TAM for fintechs & maybe an even bigger TAM for broader tech world.

C) "Unit is competing with 100 other identical BaaS and can't differentiate"

So let's close on (C). Here's the thing, Unit was built different.

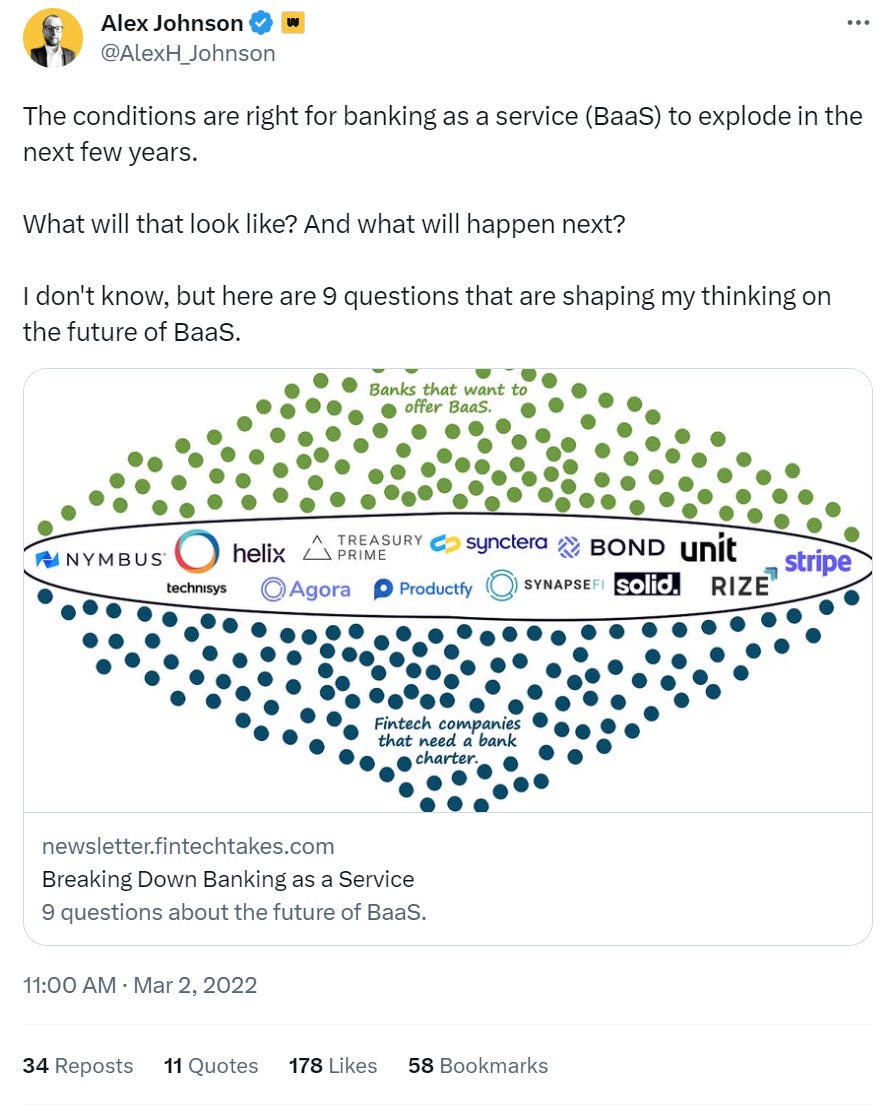

Not going to define BaaS because @AlexH_Johnson already did (and you should read his post!)

I group BaaS into 3 buckets:

X) Relationship Brokers: @treasuryprime @synctera

Y) Infrastructure Providers: @column @lithic @stripe @marqeta

Z) Full-Service Platforms: @synapsefi @unit_co_

Only Z will survive.

The only way to accomplish (A) better margins and (B) full stack capability is with a full service platform. There are so many vendors, configs, relationships, responsibilities that it's impossible to run banking successfully initially without the white glove Unit offering.

Let me emphasize the dimensions Unit offers:

5 Products (Banking, Processing, Credit, Debit, Ledger)

3 End-User Types (Consumers, Freelancers, Business)

3 Sizes (Startups, SMBs, Enterprise)

3 Use Cases (Express, Point Solution, Full Stack)

5 Revenue Streams (Interchange, Lending, Subscription, Transaction Fees, Deposit Yield)

5+ Banks

= >3K combos

Unit does this at fair pricing that still works on a unit economic level, so with Unit you're partnered with a firm that won't run itself out of business. There's also an ethos of product capability & transparency that sets it apart (see http://unit.co/guides).

So that's the story. In the game of BaaS, Unit will win. But if Unit is so great, why am I leaving?

It's less that I left, and more that I just had an amazing opportunity I couldn't say no to at Hudson River Trading (HRT).

I'm joining old colleagues at a scaled firm in an industry that got me into fintech - market structure. My role now includes Corporate Development & Ventures, areas I always wanted to own. And I'm learning from SMEs. I'm the dumbest person in the room & I love it.

I'll be a long-term equity holder at Unit & support the team. It's a perfect place for folks seeking high caliber product who are eager for a startup experience. I got major early days Sift & Chime vibes at Unit - it's special.

@itaidamti thank you for the opportunity.