Why Contribution Profit is the hidden metric that really drives unit economics

Original tweet thread:

Full post:

You know what really grinds my gears? When otherwise clever fintech nerds still quote "Gross Profit" like it's a metric that matters for a neobank fintech.

Every operator knows that "Contribution Profit" is the hidden metric that really drives unit economics.

Let's take a step back and define these metrics for fintechs.

Gross Profit is revenue less directly attributable transaction-based costs.

When a user swipes their card, it's the fees for the payment network, processor & sponsor bank that you pay for every txn every time.

Gross Profit is GAAP (The accountants give it a 👍🏾). So I get it. You'll always see gross profit (GP) in the financials with helpful breakouts & margin calcs.

Gross Profit is a cute metric that lets you rep the "tech" part of your fintech to comp to pure tech / SaaS.

But Contribution Profit (CP) is what really matters. It's Gross Profit less other variable expenses.

That user experiences fraud? Or they call support? That should net out of CP. The expense isn't there every time but it definitely scales & changes unit profitability.

Contribution Profit doesn't get front billing - it's a convoluted footnote. Why? Because CP isn't GAAP. The accountants haven't agreed on what CP should include so they don't require it (?!).

But you've got to wonder why every fintech still reps CP if they don't have to?

Contribution Profit reflects true cost to serve.

"I can run my neobank w/o a risk or a customer service unit" - said no one ever.

CP is how operators run the business & measure ROI (payback, LTV:CAC) & it's in S-1s to align the external equity story to internal operations.

Here's how real neobank P&Ls should read:

Interchange

Other (ATM fees, Partnerships, Subs)

Total Revenue

Processor

Network + Incentives

Bank

ATM network

Total COGS

Gross Profit

Txn Losses

Dispute Ops

Customer Support

Total Variable OpEx Contribution Profit

Once you recognize the value of CP, you'll be like me and look for it in every disclosure.

You won't often find it in the 10Qs or 10Ks but you might see it in an S-1 (or SPAC IPO pres), shareholder letter or an investor pres.

Here's 3 recent examples of CP in the wild.

#1: @CashApp: How to hide a neobank P&L

Square does a lot of amazing things, but the real magic is how they hide Cash App contribution profitability.

Cash App was launched in 2013 and Cash Card in 2017, but until 2020 they didn't even split out Cash App as a segment.

In 2021 they improved segment reporting, but the accountants still have some fun.

A few gems with Cash App:

Interchange is "Subs & Services Revenue" not "Txn Revenue" (but P2P fees are Txn Rev not Services Rev)

Bitcoin Rev includes the price of bitcoin + their fee

Square splits Rev & COGS by product on a consolidated basis but not by segment (see img)

They put P2P losses in S&M

They don't split out Ops & Support from G&A

So don't expect to find Cash App Contribution Profit in any typical reporting.

But there is another way.

Look at an investor pres for this (Sep '20). For payback calcs, they calc "Variable Profit" (Contribution) as Cash App & Card gross profit - P2P exp - risk loss.

So for ROI, they confess true cost to serve. They're missing Support & no there's no breakout but it's a start.

#2 @SoFi: Honest (not pretty) neobank P&L

Maybe b/c SoFi went public via SPAC*, it's one of the few fintechs to report contribution profit upfront.

It's not detailed & it's not good but it's there.

*Yes it is weird that SPAC reporting is more useful than GAAP reporting

SoFi has 3 reportable segments & "Financial Services" is basically their neobank (excl. lending).

You'll see Segment Contribution Profit in regular reporting which they define as segment revenue - directly attributable expenses (direct exp + attributable employee exp).

The main issue with SoFi is that everything is grouped in "Directly Attributable Expenses" so we don't really know whether that truly includes all COGS, Losses, & Ops/Support.

But since it's actually NEGATIVE thru '21, which is surprisingly bad, I assume it's fully loaded.

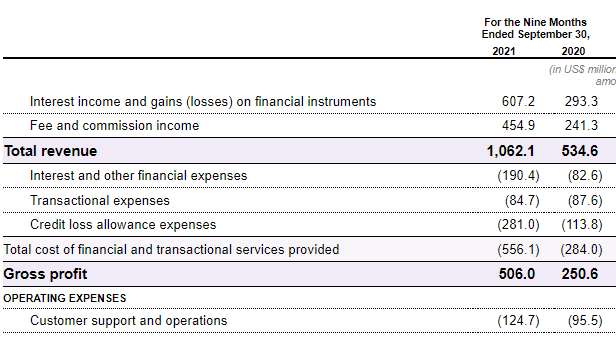

#3 @Nubank: Almost the Nu Neobank P&L

NuBank is the nu-est but learned from the past.

It's too bad they don't call out Contribution Profit explicitly BUT their detailed P&L has Gross Profit that incl. losses & they even split out Ops/Support to make true CP calcs easy.

Fun fact: Per the P&L, NuBank Gross Profit is Revenue - COGS - Losses.

And per the prospectus box, their Contribution Profit is Revenue - COGS - Losses.

Yes, dear fintech friends, those are the same! Maybe an operator's mistaken call for help?

Probably nothing.