Will the real fintech valuation please stand up?

Will the real fintech valuation please stand up?

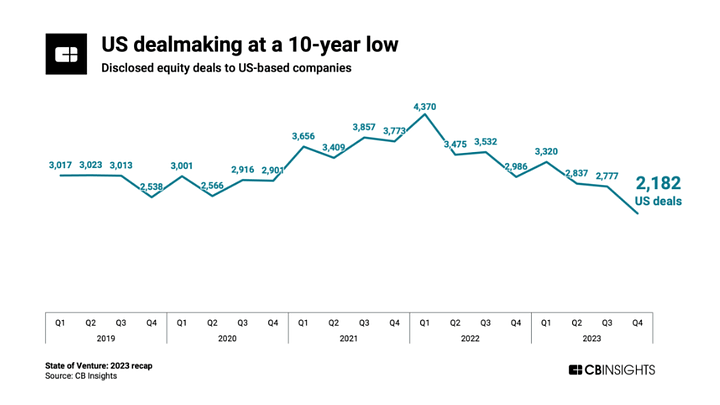

Among fintech operators, we've been confused with the state of the fintech markets recently. If a bunch of public fintech companies market caps are up and to the right, why are private companies still down bad?

Fintech nerds will jump in that startups raising rounds now need cash so they're taking downrounds.

And you know - they're absolutely right.

But I'm not talking about those companies.

I'm talking about pre-IPO fintech firms that we all know and that seem to be doing okay.

You might ask how to know the valuation of a company w/o a priced round? That's where secondary markets come in: @EquityZen @Forge_Global @Hiive_HQ, @noticedotco allow anyone w/ company equity to sell it to others, usually for a ~2-5% fee. Marketplace price = valuation. And thanks to my favorite marketplace for valuation analytics @noticedotco, I'm seeing this weird disconnect between public and private company valuations.

Here's that comparison for 5 major fintechs, indexing back to when the private company last raised in a priced round:

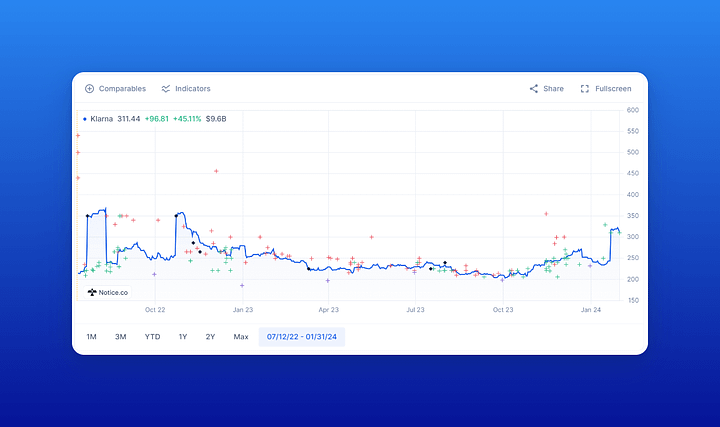

#1 Klarna vs. Affirm

Now, Klarna admittedly took a beating when it took a 85% valuation haircut to $6.7bn in Jul-22, and it's def improved to $10bn, up 45%. But look at Affirm, up a whopping 77%. Why the delta?

#2 Ramp vs. Intuit

Ramp also took a ~28% haircut to valuation to $5.8bn in Aug-23, but it's continued to grow, yet private markets have it at $5.5bn, down 6%. Meanwhile, Intuit is up 29% during the same period. What's up?

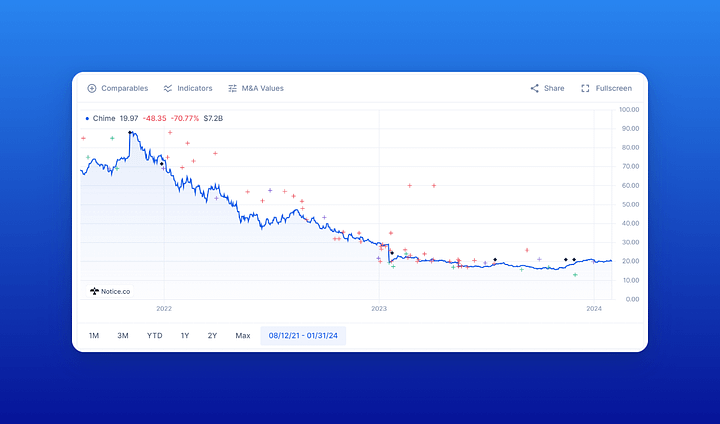

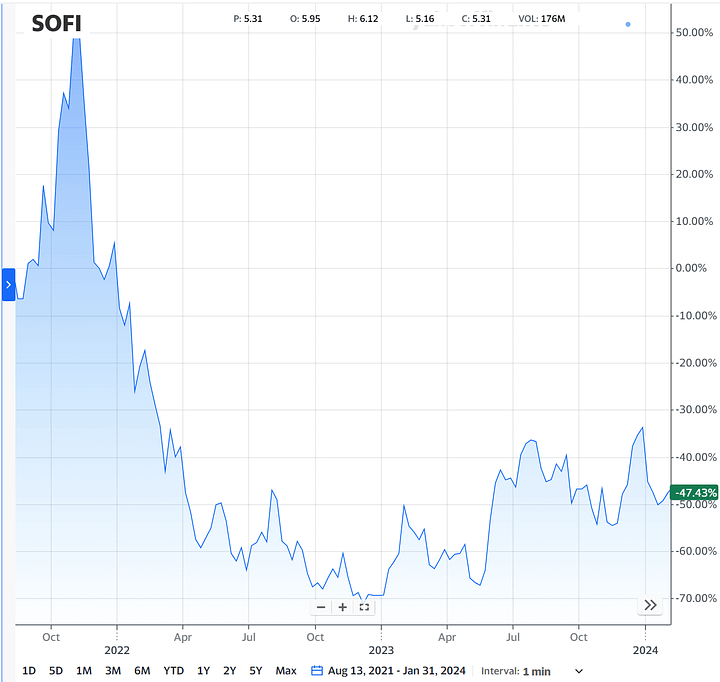

#3 Chime vs. SOFI

Chime was last valued at $25bn at Series G in Aug-21, but private markets set it at $7bn, down 71%. Meanwhile, Sofi is hanging in there, down only 47% over the same period. Does not compute.

#4 Plaid vs. Envestnet

Plaid last raised at a buzzy $13bn in Apr-21 after the Visa/Plaid deal breakup but private markets see it at $3bn, down 78%. And then Envestnet / Yodlee, a Plaid alternative, over here down 30% over the same time period. What gives?

#5 Stripe vs. Paypal*

The only hope is Stripe.

Last raised publicly at a $50bn in Mar-23. Now, according to private markets, it's worth $65bn, up 30%. Starting from the same period, Paypal is down ~16%

*Folks often use Adyen but geo risk makes comparison noisy.

I know there's a lot of different dynamics here including differences in information sharing, lower liquidity in private markets and pre-IPO discounting, but the deltas in comparable comp valuation are big enough to make me wonder.

When do we think private markets will rationalize?